How to Properly Buy Land: Essential Steps to Make Informed Decisions in 2025

“`html

How to Properly Buy Land: Essential Steps to Make Informed Decisions in 2025

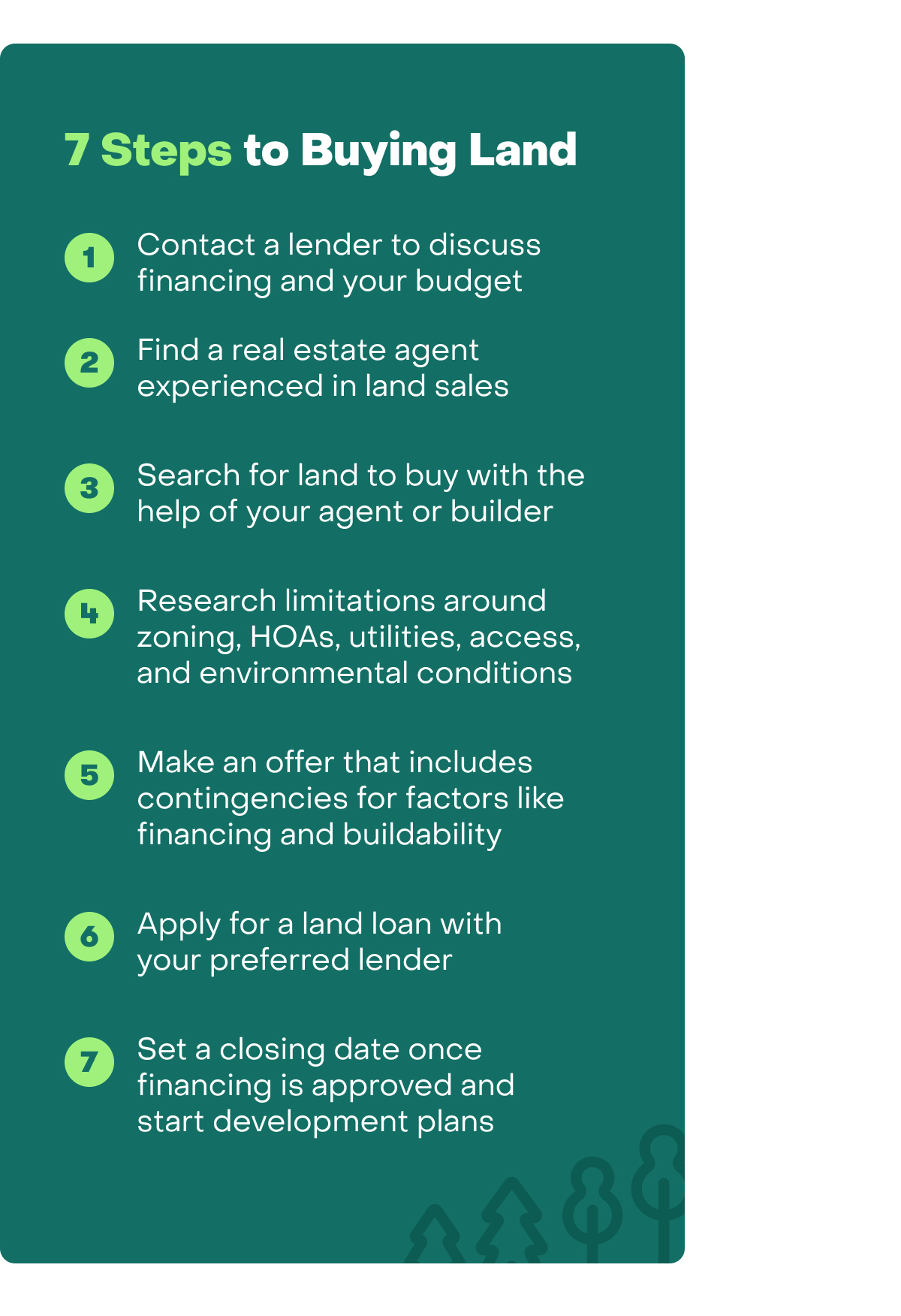

Understanding the Land Purchase Process

Buying land can be one of the most rewarding investments anyone can make, whether for residential, agricultural, or commercial purposes. However, understanding the land purchase process is crucial. It involves evaluating various factors, securing financing options, and conducting thorough due diligence before making a commitment. This process can often require detailed research and careful planning to ensure that your investment aligns with your long-term goals. In this section, we’ll walk through the essential steps to safely navigate the journey of land acquisition.

Finding the Right Land for Sale

Finding land for sale is usually the first step in the land acquisition process. Potential buyers can utilize various resources, such as online land markets, to browse listings. It’s also beneficial to engage with land brokers or a reputable real estate agent who specializes in land transactions. They have insights into the local market conditions and can provide valuable information on zoning laws, land use regulations, and potential land value biases.

Evaluating Land Value and Suitability

When considering a piece of property, it’s vital to evaluate land value. Factors influencing this can include location, access to resources, and environmental assessments. Conducting a land appraisal can offer insight into the property’s fair market value. Additionally, buyers should consider performing land inspections to ascertain whether the land meets their specific needs—be it for residential development, agriculture, or investment purposes. Understanding land investment risks and potential return on investment can shape your decision significantly.

Understanding Legal Documents for Land Ownership

The crucial aspect of the land buying process involves comprehending legal documents for land. Common documents include the land sales agreement, title deeds, and disclosures pertaining to potential land use restrictions. A title search is necessary to confirm the successful transfer of land ownership rights. It’s advisable to work with legal professionals experienced in property transactions to ensure complete transparency throughout the process.

Financing Options for Land Purchase

Financing land acquisitions can differ significantly from traditional home loans. Multiple land financing options are available, including loans specifically designed for land purchases and agricultural land investments. Understanding your financial possibilities is critical. Buyers should assess their budget, considering both purchase costs and long-term ownership implications, such as land taxes and ongoing maintenance expenses.

Exploring Land Financing Methods

There are several ways {for buyers to finance their land purchase in 2025. Along with traditional loans offered by banks, buyers might explore options like owner financing, where the seller provides financing directly. Additionally, land improvement loans can help with necessary developments. Before proceeding, calculate land acquisition costs carefully and consult with a financial advisor to comprehend your financing choice’s long-term impacts fully.

Working with Land Payment Plans

Some sellers may offer payment plans as an enticing financing option. This could potentially lower entry barriers for investors, enabling smoother negotiations on the land purchase negotiations. Be sure to draft clear land purchase agreements outlining payment terms, considering applicable interest rates, and payment schedules. The emphasis should always remain on assessing how those terms align with your financial health and objectives.

Utilizing Land Leasing Options

In specific situations, land leasing options can provide flexibility in real estate investments. Leasing land offers buyers a means to generate revenue through agricultural use or by developing commercial properties without immediate full ownership costs. For investors hesitant about committing to a purchase, leasing could act as a suitable stepping stone while also allowing them to evaluate the land’s potential for appreciation over time.

Due Diligence and Land Inspection Process

Conducting comprehensive due diligence forms the backbone of making an informed land investment. Before committing to any property, it’s critical to engage in a thorough investigation to avoid potential pitfalls in land buying. This includes examining zoning regulations, conducting (or hiring professionals for) property inspections, confirming access to utilities, and assessing land use potential.

Performing Land Inspections and Surveys

A vital component of the due diligence process is to perform land inspections. This includes verifying physical boundaries, reviewing survey reports, and identifying any environmental concerns, such as drainage issues or wildlife habitats. Utilizing tools like cadastral surveys helps clarify property lines and can mitigate conflicts with neighboring parcels. Documentation from these inspections serves to fortify your negotiation position and secure favorable terms in a land purchase agreement.

Understanding Zoning Laws and Land Use Regulations

Zoning laws dictate how land can be utilized—residential, agricultural, or commercial—and must be understood before proceeding with any land purchase. Engaging with local authorities or planning documents helps to grasp current and future land development potential. Learning about applicable land use regulations also educates clients on compliance responsibilities and future modifications. Understanding these regulations directly impacts potential ROI and value appreciation.

Analyzing Market Conditions and Land Trends

Keeping abreast of market conditions is paramount for any buyer. Property market analysis tools can help you assess local trends and varying price points for different area types, whether it is rural or urban land purchases. Knowledge of investment property trends facilitates strategic planning, thereby enhancing prospects for both immediate and long-term ventures.

Finalizing the Land Acquisition Process

Once you’ve selected the ideal property and aligned your financing options, the final stage in the land purchase process is overseeing the closing steps. This involves completing the legal paperwork, executing the escrow process, and ensuring all conditions have been met before ownership is transferred. By systematically following these steps, you’ll pave the way towards successfully securing your land.

Navigating the Land Transfer Process

During the land transfer process, ensure all necessary legal documentation has been provided, including verified title documents, and agreements outline all parties’ obligations or rights. Typically, a reliable escrow agent coordinates this transaction to facilitate payment transfer while ensuring fulfillment of all conditions before hands are exchanged. It’s crucial for every buyer to understand their legal responsibilities associated with land ownership as they transition from buyers to owners.

Understanding Taxes and Fees Associated with Land Ownership

Once the acquisition process concludes, buyers enter into a landscape limited by land tax implications and ongoing ownership responsibilities. Familiarizing yourself with local tax policies, including property taxes and any that may arise with a change of use, is essential for long-term cost forecasting while maintaining compliance with local laws.

Developing an Investment Strategy

Post-purchase, it’s helpful to construct a solid land investment strategy. Clearly define your ownership aspirations by gauging timelines for development, recognizing your target market, and considering ways to maximize land utility. Enabling a vision for your land investment can bolster financial returns and provide substantial personal satisfaction.

Key Takeaways

- Thoroughly evaluate land value and suitable financing options before engaging in land purchases.

- Conduct exhaustive due diligence, including inspections and understanding zoning laws.

- Engage qualified professionals, like land brokers and real estate agents, throughout the process.

- Understand ongoing tax implications and the importance of concluding the escrow process properly.

- Formulate a long-term investment strategy for utilizing your acquired land effectively.

FAQ

1. What are the common financing options for purchasing land?

Common financing options include traditional bank loans, seller financing, and land loans offered by specialty lenders. Each option has different interest rates and repayment terms. Completing thorough research is essential in applying them correctly to financing land acquisitions.

2. How can I evaluate the value of a piece of land?

Evaluating land value involves examining its location, surrounding market conditions, and any physical inspections. Getting a professional land appraisal provides an accurate assessment of fair market value, taking into account land use regulations and zoning laws.

3. What legal documents are required for buying land?

The requisite legal documents usually include a land sales agreement, property title deeds, and a title search report. It’s wise to involve an attorney or legal expert for overseeing document completion and ensuring no unexpected issues arise.

4. Are there risks associated with land purchases?

Yes, there are risks that include zoning restrictions, environmental assessments, and potential boundary disputes. Conducting thorough due diligence and utilizing professional help minimizes risk exposure significantly.

5. How do local zoning laws affect land use?

Local zoning laws dictate how land can be utilized and may impose restrictions on developments. Understanding these regulations helps buyers ensure their intended use aligns with local laws, thus maximizing investment potential.

“`