Effective Ways to Use QuickBooks for Streamlined Financial Management in 2025

“`html

Effective Ways to Use QuickBooks for Streamlined Financial Management in 2025

As businesses evolve, the need for effective financial management becomes paramount. QuickBooks, one of the leading accounting software solutions, continues to provide users with various tools to manage their financials efficiently. In this article, we will explore the various functionalities of QuickBooks and offer a QuickBooks setup guide that will help you master the software and streamline your financial management in 2025.

Overview of QuickBooks Features

Understanding the multitude of QuickBooks features is essential for harnessing the full potential of this accounting software. QuickBooks offers diverse functionalities, including expense tracking, reporting tools, and invoicing processes. Knowing how to utilize these features effectively can enhance your accounting experience and lead to better financial control.

QuickBooks Basic Functions

At its core, QuickBooks provides a range of basic functions designed to lead businesses through essential accounting processes. Key among these are QuickBooks customer management and expense tracking. Effective customer management is crucial, as it allows businesses to maintain records of transactions, communications, and invoices associated with each customer. In parallel, robust expense tracking is necessary to keep expenditures organized, ensuring you maintain a clear picture of business finances. Utilizing these basic functions strategically can save time and improve your overall management of finances.

QuickBooks Invoicing Process

The QuickBooks invoicing process is user-friendly and customizable, making it possible for businesses to generate invoices quickly and efficiently. Users can create either standard invoices or recurring invoices for regular customers. By leveraging templates and setting reminders, businesses can automate the invoicing process, which minimizes the likelihood of missed payments. This not only improves cash flow but also enhances customer relationships by providing timely and professional billing.

QuickBooks Reporting Tools

Accessing comprehensive financial insights is critical for any business, and that’s where QuickBooks reporting tools come into play. These tools allow users to generate detailed financial statements, such as profit and loss reports and balance sheets. Reports can be customized based on specific categories, helping businesses pinpoint areas for improvement, forecast future revenues, and guide pricing strategies. By taking full advantage of these tools, you can make informed decisions and optimize your financial management.

Setting Up QuickBooks for Success

Effective use of QuickBooks begins with the initial setup. Taking the time to properly configure the software upon installation significantly influences long-term success. Remember to follow a QuickBooks setup guide to configure your user accounts, integrate necessary apps, and establish your accounts correctly from the start. Setting goals and utilizing appropriate tools during the setup can lead you to discover tailored solutions that align with your unique business needs.

QuickBooks Installation Steps

The QuickBooks installation process may seem daunting, but by following a systematic approach, establishing your accounting environment becomes seamless. From downloading the software to installing the essential features tailored to your business, each step is crucial. Begin by ensuring that your system meets the specifications before downloading and installing QuickBooks. Following the tutorials provided on installation will ensure all necessary modules—such as payroll management, sales tax management, or even the QuickBooks mobile app—are aptly configured, readying your environment for a smooth transition.

QuickBooks User Accounts Setup

Creating multiple QuickBooks user accounts is essential for businesses that utilize different operational roles within the software. This flexibility ensures that sensitive information is securely shared while maintaining control over access to specific features. Administrators can assign permissions based on job functions, allowing team members to use the software specific to their roles—whether in payroll processing, client management, or inventory control. Establishing these accounts as part of your QuickBooks setup improves efficiency and security.

QuickBooks Integration Options

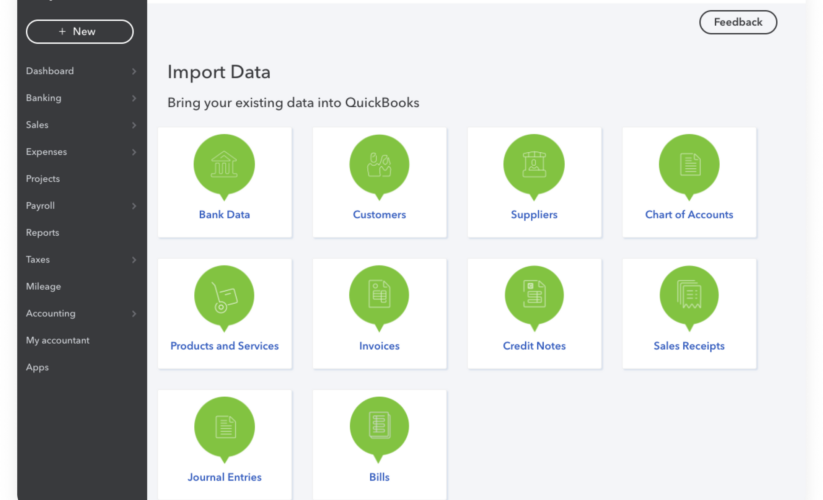

Another benefit of using QuickBooks is its broad selection of QuickBooks integration options. Integrating this software with other applications can streamline your processes significantly by enabling seamless data flow between systems. From connecting your CRM to syncing with e-commerce platforms, integration aids in accurate data management and ensures you’re maintaining coherent financial records. Optimizing integration helps reduce manual entry errors, saving you valuable time and enhancing overall productivity.

Utilizing QuickBooks for Advanced Financial Management

To fully leverage QuickBooks, honing your skills on its advanced functions will allow for efficient finance management. Utilizing features such as budgeting tools, financial reporting, and payroll services can transform how you manage finances. Understanding these functions in detail will enable your business to achieve better cash flow management and informed decision-making strategies.

QuickBooks Financial Reporting

Elevating your understanding of QuickBooks financial reporting opens doors to in-depth insights that drive strategic planning. Financial reports like cash flow statements, income reports, and expense breakdowns provide data-driven analysis, helping owners anticipate financial trends and resolve budget discrepancies. Knowing how to create and interpret these reports aids businesses in maintaining long-term financial health and accountability.

QuickBooks Payroll Setup

If your business employs staff, understanding the QuickBooks payroll setup is essential. This feature streamlines the payroll process and ensures accurate calculations of salary, bonuses, or taxes, improving compliance with legal obligations. By integrating banking information and configuring preferences based on employee contracts, QuickBooks can operate efficiently, allowing businesses to pay employees on time while minimizing errors in payroll procedures.

QuickBooks Budgeting and Forecasting Tools

The QuickBooks budgeting tools guide businesses in creating a roadmap for future financial performance. Developing a budget based on the past earnings and applying forecasting techniques enable businesses to set realistic goals and track their financial trajectories. QuickBooks allows users to compare actual performance against budget projections, enabling timely adjustments. Employing these tools serves as a proactive measure in managing business finances and preparing for potential challenges.

Best Practices for Using QuickBooks

To maximize your experience with QuickBooks, employing best practices is crucial for troubleshooting and optimizing your usage. Commit to regular updates, backups, and proactive monitoring of your accounts to stay compliant and informed. Understanding QuickBooks serves as a basis for enhancing financial performance, but adopting structured practices behind the scenes is what ensures reliable results.

QuickBooks Backup Strategies

Protecting your financial data is non-negotiable. Implementing QuickBooks backup strategies plays a significant role in securing against data loss. Utilize the cloud-based backup option provided by QuickBooks or set regular manual backups to external devices. Regular assessments help ensure your data is current and retrievable, providing peace of mind for your financial asset integrity.

Common QuickBooks Troubleshooting Tips

Encountering challenges with software is inevitable; however, understanding some basic QuickBooks troubleshooting tips will improve efficiency. Common issues include sluggish performance or difficulties with reconciliations. Check your internet connection, ensure that you have the latest updates, and utilize on-screen help functions. Additionally, using the support section effectively, or reaching out to QuickBooks customer support can assist in quickly resolving persistent issues.

Advanced QuickBooks Features for Improved Efficiency

In addition to the basic functions, exploring the advanced QuickBooks features, such as item setup and project tracking tools, allows businesses to streamline tasks even further. These features enhance functionality and facilitate better tracking of particular projects’ profitability and costs, making sure that operations remain efficient while expenses are managed appropriately. Understanding these advanced tools proves critical for strategic planning and maintaining competitive advantage.

Key Takeaways

- Utilize the myriad QuickBooks features for efficient financial management.

- Invest time in proper QuickBooks setup to tailor the software to your business needs.

- Harness the power of financial reporting to inform strategic decision-making.

- Implement regular backups and updates for sustained data security and reliability.

- Explore advanced functionalities to maximize productivity and efficiency.

FAQ

1. What makes QuickBooks ideal for small businesses?

The versatility of QuickBooks accounting software makes it ideal for small businesses because it offers a wide range of features including invoicing, expensing tracking, and robust reporting tools, all at affordable pricing tiers.

2. How can QuickBooks help manage my business finances?

QuickBooks streamlines the financial management process by integrating features such as customer management, payroll setup, and budgeting tools, allowing businesses to focus on growth while keeping finances organized and transparent.

3. What is the easiest way to get started with QuickBooks?

To get started with QuickBooks, follow a structured QuickBooks setup guide which includes creating user accounts, configuring settings based on your business, and learning to use core features such as invoicing and expense tracking.

4. Are there training resources available for QuickBooks users?

Yes, QuickBooks offers a wealth of training resources, including online tutorials, help guides, and support forums, ensuring that users can learn the ins and outs of the software effectively.

5. What are some common QuickBooks issues to look out for?

Some common issues include data-entry errors, problems during bank reconciliation, and software performance issues. Users should familiarize themselves with troubleshooting resources to mitigate these problems swiftly.

6. Can I access QuickBooks on my mobile device?

Yes, downloading the QuickBooks mobile app allows you to manage finances on-the-go, providing functionalities similar to the online platform and ensuring easy access to your business accounts and insights anytime, anywhere.

7. How can integrating QuickBooks with other tools benefit my business?

Integrating QuickBooks with other business tools like CRM systems or project management applications automates workflows and ensures accurate information sharing, improving efficiency and potentially leading to better customer relationships.

“`